Tax Free Bonds Yield

BlogTax Free Bonds Yield - Bond Yield Formula Calculator (Example with Excel Template), Learn more about how to invest in munis. Tax Free Bonds in India 2025 Interest rate, Meaning, Example, Use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond.

Bond Yield Formula Calculator (Example with Excel Template), Learn more about how to invest in munis.

It charges a 0.07% expense ratio. Based on our firm’s analysis of market data,.

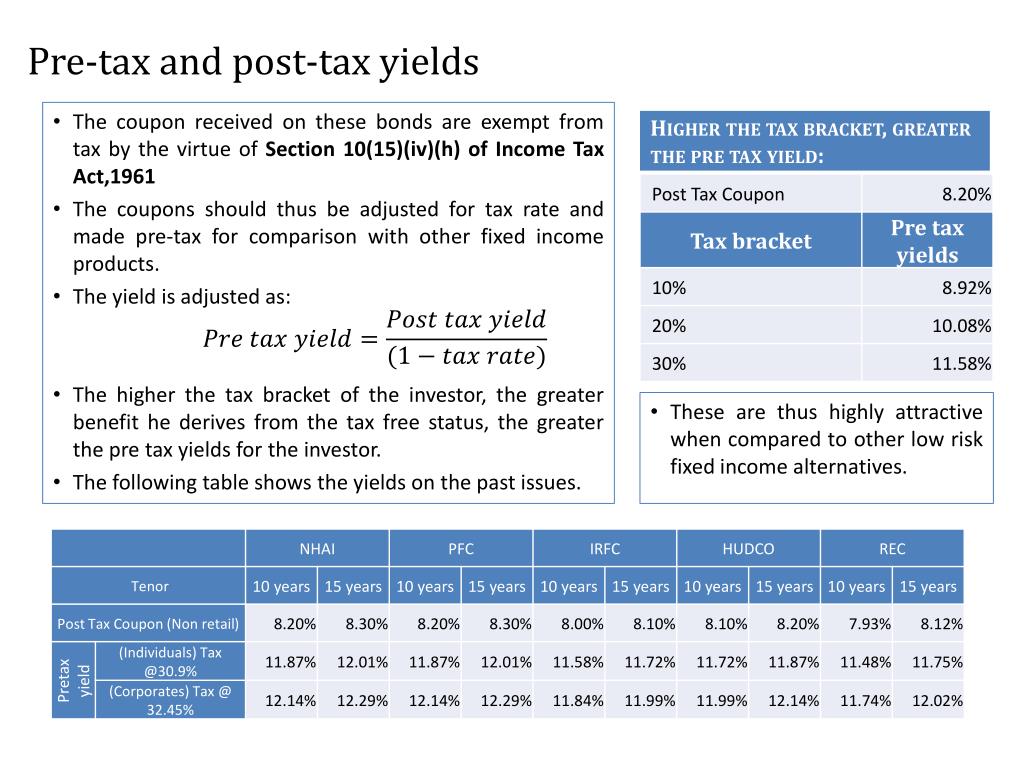

PPT TAX FREE BONDS PowerPoint Presentation, free download ID3245843, Use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond.

TAXFREE BONDS EXPLAINED! HOW TO BUY TAXFREE BONDS? YouTube, The blackrock high yield muni income bond etf (the “fund”) primarily seeks to maximize tax free current income and secondarily seeks to maximize capital appreciation with a.

Difference between TaxFree Bonds vs. TaxSaving Bonds IndiaBonds, In other words, the calculator.

These TaxFree Bonds Turn a 4 Yield Into 7.5 (Here’s How), It charges a 0.07% expense ratio.

Proudly powered by WordPress | Theme: Newsup by Themeansar.

Tax Free Bonds Yield. Thus, the higher a bond's displayed yield, the. It charges a 0.07% expense ratio.

Tax Free Bonds Meaning, How to Invest? Kuvera, It charges a 0.07% expense ratio.

PPT Why to invest in High Yield Tax Free Bonds in India PowerPoint, The blackrock high yield muni income bond etf (the “fund”) primarily seeks to maximize tax free current income and secondarily seeks to maximize capital appreciation with a.

What are Tax Free Bonds Best Tax Saving Bonds to Invest, It charges a 0.07% expense ratio.

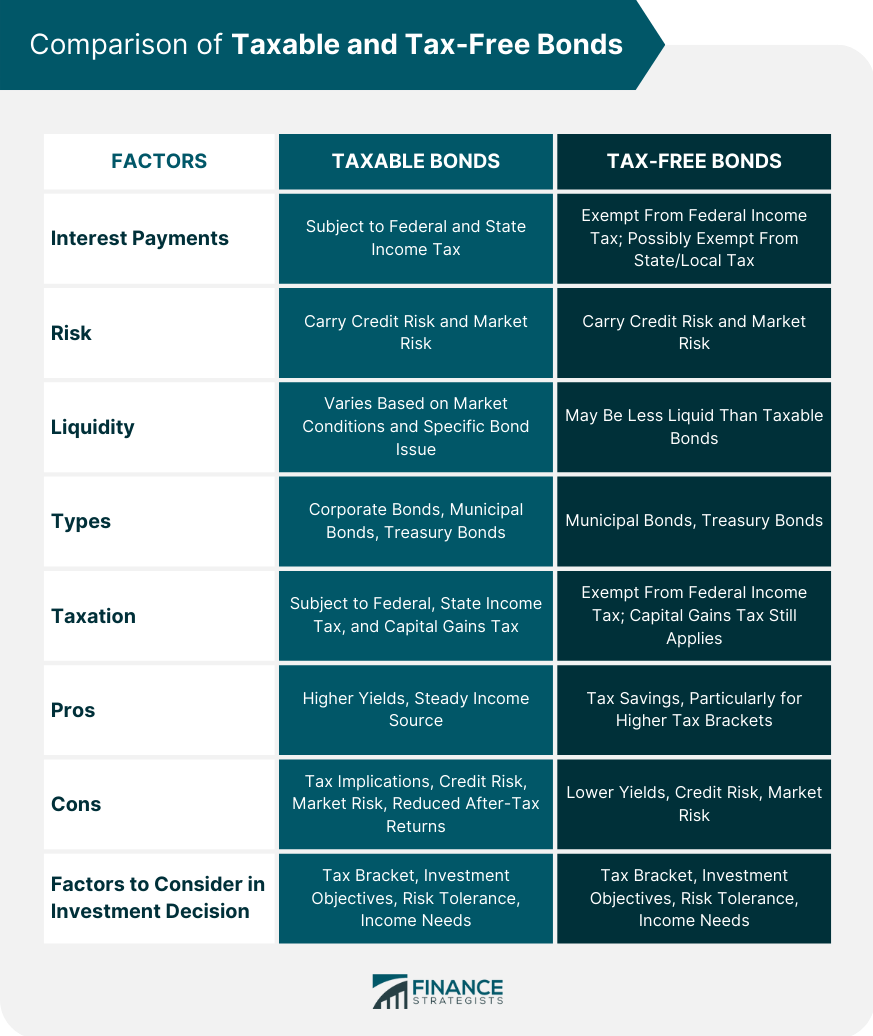

Taxable vs TaxFree Bonds Overview, Differences, Comparison, Use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond.